The changing landscape of online payments in Europe

This article summarizes the presentation from the Merchant Payments Ecosystem 2024, shedding light on the evolving landscape of online transactions in Europe and the necessity of local payment methods. With our CEO, David Rintel, at the forefront, key insights into online payment trends and innovations are explored, offering a glimpse into the dynamic shifts shaping the industry.

The changing landscape of online payments in Europe

David Rintel, CEO, TrustPay

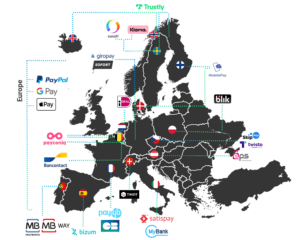

The European payments landscape is undergoing a significant transformation, with Visa and Mastercard losing their dominant positions in several markets. This shift indicates a substantial change in consumer preferences and the rise of local payment methods across the continent.

Key Points:

- Diverse market trends: In at least 10 European markets including Belgium, Denmark, Finland, France, Germany, the Netherlands, Poland, Portugal, Spain, and Sweden, Visa and Mastercard are no longer the dominant payment methods, affecting more than 50% of Europe’s population.

- Emergence of local alternatives: Local payment methods such as iDeal in the Netherlands, Blik in Poland, and Bancontact/Payconiq in Belgium have gained significant market shares, overshadowing traditional card networks.

Hybrid payment experiences: Innovative approaches like Payconiq by Bancontact offer hybrid payment methods, seamlessly integrating standalone apps or banking apps with card payments or account-to-account transfers. Ultimately, user experience is more important than the rails a payment method runs on.

Common themes and drawbacks of local payment methods:

- Advantages: These methods offer streamlined user experiences with features like no manual data entry, enhanced security, QR code-based transactions, and integration into banking apps. They are also cheaper for merchants and ensure guaranteed payments.

- Drawbacks: Despite their popularity, local payment methods may lack support for certain use cases like recurring billing and pre-authorization. Additionally, they may not provide robust consumer protection mechanisms and often lack pan-European reach.

Impact of open banking and future projections:

- Open banking: While open banking shows growth potential, challenges remain such as inferior user experiences and a lack of payment guarantees. Standardization of APIs and user experiences is necessary for its widespread adoption.

- Future trends: The future of e-commerce payments in Europe is likely to see continued decline in card usage in favor of tokenized wallets like ApplePay and A2A payment schemes such as Blik. Local card schemes may need to innovate to remain relevant.

The European payments landscape is dynamic and rapidly evolving, characterized by the proliferation of local payment methods and the advent of open banking. As the pace of change accelerates, businesses must adapt by partnering with flexible payment providers capable of navigating this complex landscape. With more fragmentation expected in the future, agility and adaptability will be crucial for success in the European online payments market.