How to improve approval rates for online transactions: Key insights for merchants

For merchants, improving approval rates for online transactions is crucial for maintaining revenue flow and enhancing customer satisfaction.

For merchants, improving approval rates for online transactions is crucial for maintaining revenue flow and enhancing customer satisfaction. At TrustPay, as an acquirer and payment provider, we’ve worked with numerous merchants across Europe and beyond, helping them boost their approval rates and optimize their payment processes. In this blog, we’ll share key strategies you can implement to increase your approval rates and streamline your customers’ payment experiences.

Key strategies to increase approval rates

1. Choose the Right Payment Provider

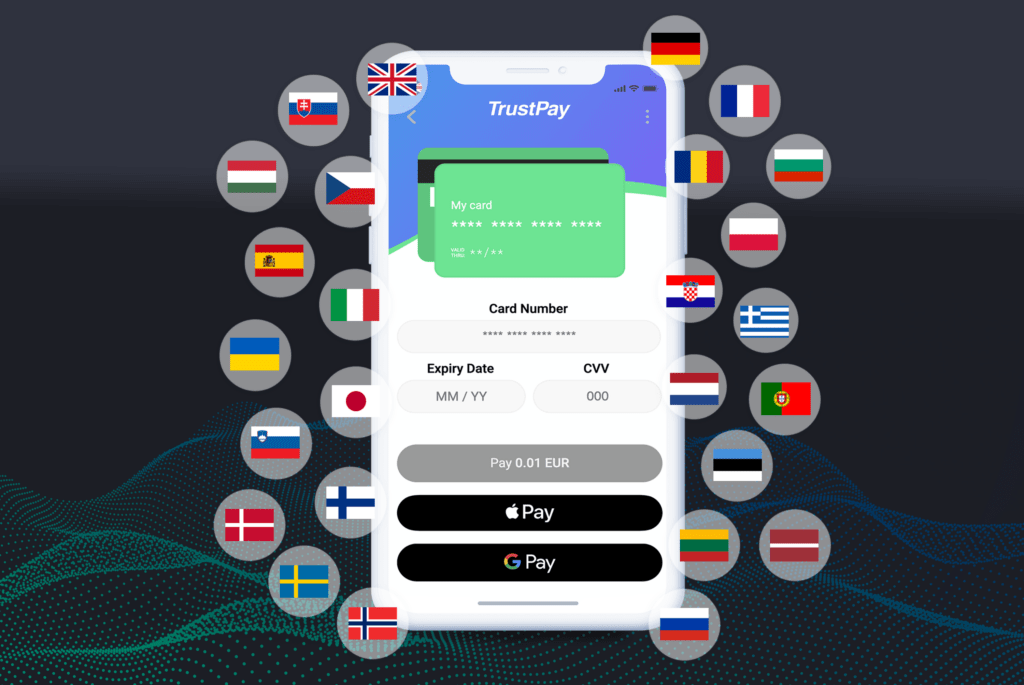

Partnering with a reliable and efficient payment provider can improve your approval rates. A provider with expertise in handling multiple currencies and offering local payment methods can significantly impact your approval rates. It is crucial to choose a provider that supports global reach, yet it understands local market dynamics.

Why TrustPay?

We offer a tailored approach to each market with support for 170 processing currencies and payment pages available in 26 languages. This ensures a seamless experience for your customers, wherever they are, and increases the likelihood of approved transactions.

-

Implement Fraud Prevention Measures

Fraud is a significant factor in transaction declines as banks and issuers tighten security protocols to avoid chargebacks. By implementing robust fraud prevention measures, you can protect your business and ensure that legitimate transactions are approved. Tools like 3D Secure (3DS) or CVV checks can be crucial in reducing fraudulent activity. Our internal risk team proactively identifies connections within the data, offering the option to block suspicious users, IP addresses, banks, and more or to advise the client.

At TrustPay, we prioritize fraud prevention without compromising the customer experience. We offer merchants advanced security tools that strike the right balance between fraud prevention and customer convenience.

-

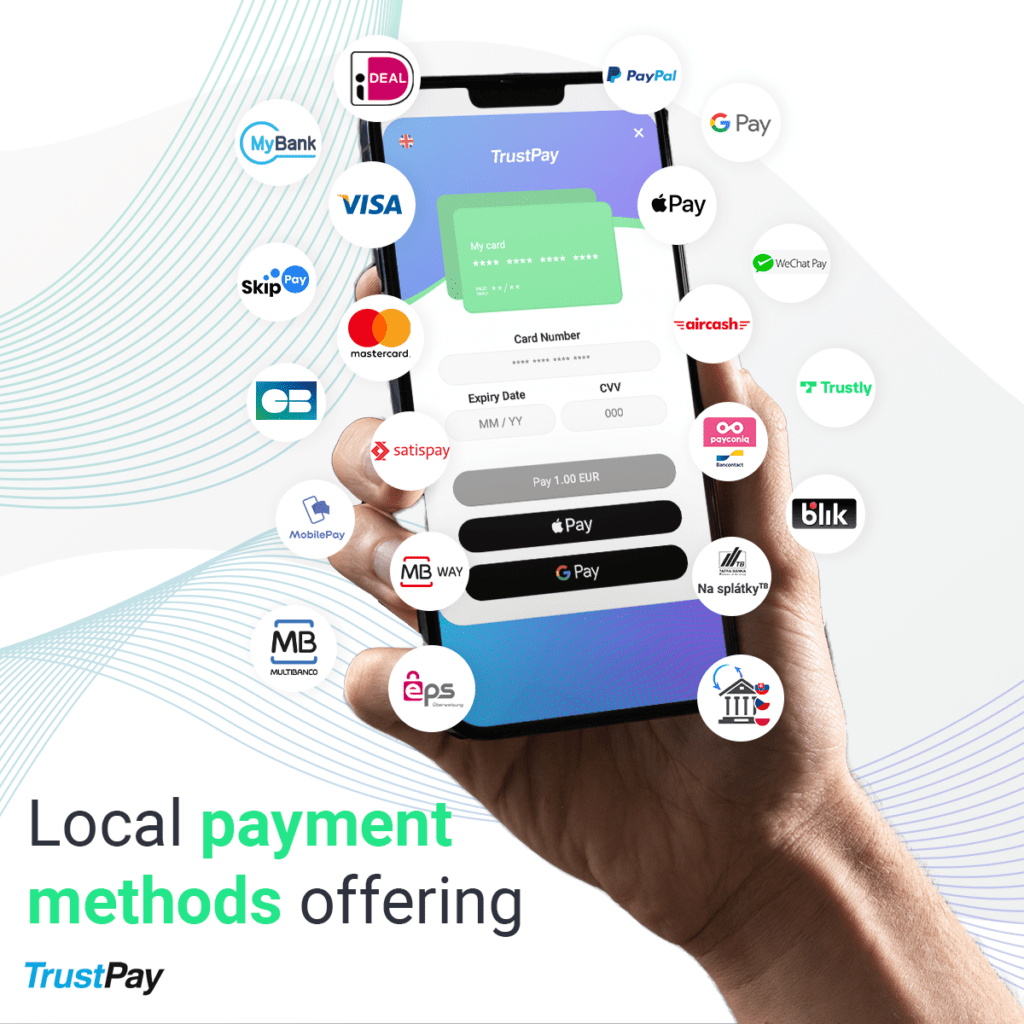

Provide Multiple Payment Options – Local Payment Methods

Offering multiple payment options, including local methods, can significantly improve approval rates, especially when expanding into new markets. Customers prefer familiar payment methods; in some regions, card payments may not be the dominant choice. By offering various solutions, from credit cards to local bank transfers and other local payment options, you can reduce friction and increase the likelihood of approval.

TrustPay supports various local payment methods, enabling you to cater to customer preferences in different markets. This not only boosts approval rates but also enhances customer loyalty and satisfaction.

-

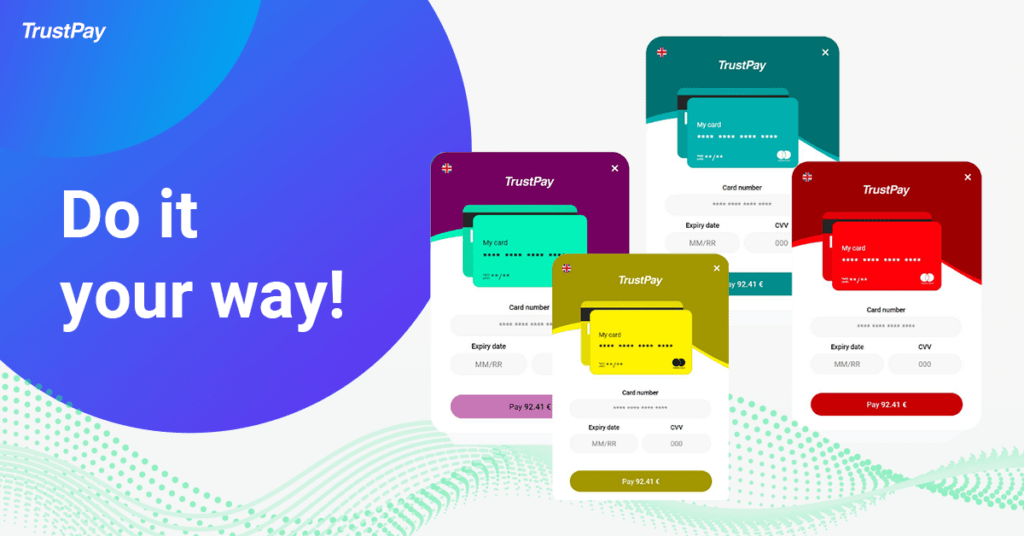

Optimize Your Checkout Process

A well-optimized checkout process can significantly impact transaction approval rates. Complicated or slow checkout pages often lead to customer frustration and abandoned carts. A streamlined, user-friendly experience will help customers complete their transactions smoothly, increasing the chances of approval.

With TrustPay’s customizable payment pages, merchants can create a seamless checkout experience that reduces friction, minimizes errors, and guides customers through the process without confusion or delay.

-

Monitor Your Payment Processing System

Real-time monitoring of your payment processing system is crucial for detecting issues early and ensuring all transactions flow smoothly. By keeping track of transaction success rates, you can quickly identify trends or problems, such as system outages or bank-specific issues, that may be causing declines.

TrustPay provides merchants with detailed reports and real-time monitoring tools to help them stay informed and act quickly to resolve any issues that may arise.

-

Understand the Reasons for Declines

Understanding why transactions are declined is key to improving approval rates. Common reasons for declines include insufficient funds, expired cards, or fraud prevention measures triggered by unusual activity. Working with a payment provider that offers detailed decline codes can help you take the appropriate action.

At TrustPay, we offer our merchants clear, actionable insights into why transactions fail, allowing you to address issues promptly and work towards higher approval rates.

-

Optimize Payment Gateway Settings

Fine-tuning your payment gateway settings can have a significant impact on approval rates.

Merchants should consult with their providers about possible process improvements, such as transaction retries, and periodically review their internal policies to guard against fraudsters. This includes adjusting fraud filters, setting up retries for soft declines, and configuring gateway rules to minimize transaction failures.

Our gateway solution allows merchants to optimize their settings for maximum approval rates, providing flexibility in processing transactions and ensuring the best possible outcome.

-

Regularly Review and Adjust Your Strategy

Payment processing is not static — industry trends, customer behavior, and security requirements evolve. Therefore, it’s important to regularly review your strategy and adapt as needed. By analyzing transaction data, fraud rates, and approval trends, you can identify areas for improvement and implement changes that enhance approval rates.

Our risk team works closely with merchants to help them refine their payment strategies over time, ensuring that they stay ahead of market changes and maintain high approval rates.

Implementing these strategies can significantly improve your online transaction approval rates. TrustPay supports you every step of the way, providing the tools and expertise to enhance your payment processing and grow your business. Let’s work together to ensure more successful transactions and satisfied customers!

For more insights on optimizing your payment processes, contact our team sales@trustpay.eu