The evolving landscape of online payments in Europe

The landscape of online payments in Europe has undergone significant changes in recent years, marked by the rise of local payment methods.

The landscape of online payments in Europe has undergone significant changes in recent years, marked by the rise of local payment methods. This evolution is driven by technological advancements, regulatory changes, and shifting consumer preferences toward more secure, convenient, and cost-effective payment solutions.

The blog delves into these trends, exploring the key drivers and future outlook of online payments in Europe, illustrated with three examples.

Evolution of Local Payment Methods

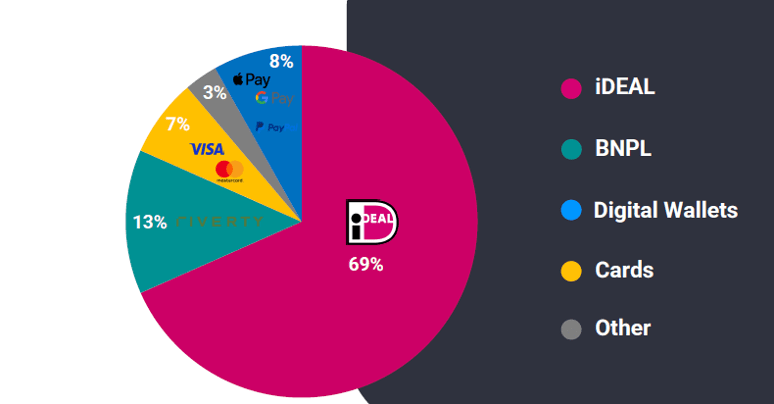

Local payment methods have emerged as dominant players in several European markets, often outpacing traditional card payments. For instance, in the Netherlands, the iDEAL payment method accounted for 69% of e-commerce transactions in 2023, significantly overshadowing card payments, which only represented 13%. This shift indicates a broader trend where consumers prefer local solutions that offer better integration with their banking systems and more convenience.

Payment Mix in the Netherlands (2023)

| Payment Method | Percentage |

| iDEAL | 69% |

| BNPL | 13% |

| Cards | 7% |

| Digital Wallets | 8% |

| Other | 3% |

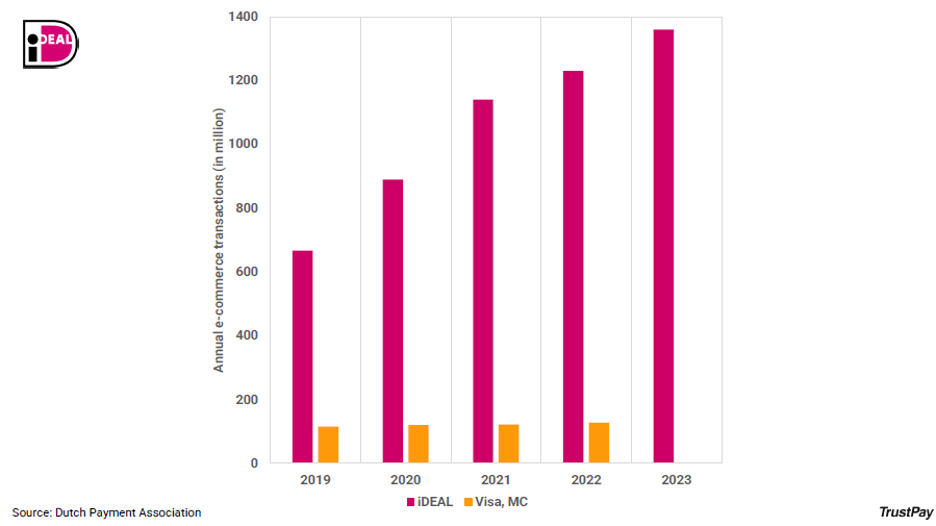

The chart illustrates the annual e-commerce transactions in millions for iDEAL compared to Visa and Mastercard (MC) from 2019 to 2023. iDEAL transactions, represented by the magenta bars, show a significant and steady increase over the years, starting from around 600 million in 2019 to approximately 1350 million in 2023.

In contrast, Visa and Mastercard transactions, depicted by the orange bars, remain relatively stable with a slight upward trend, hovering just above 100 million transactions throughout the same period. This data highlights iDEAL’s dominance and rapid growth in the Dutch e-commerce payment market.

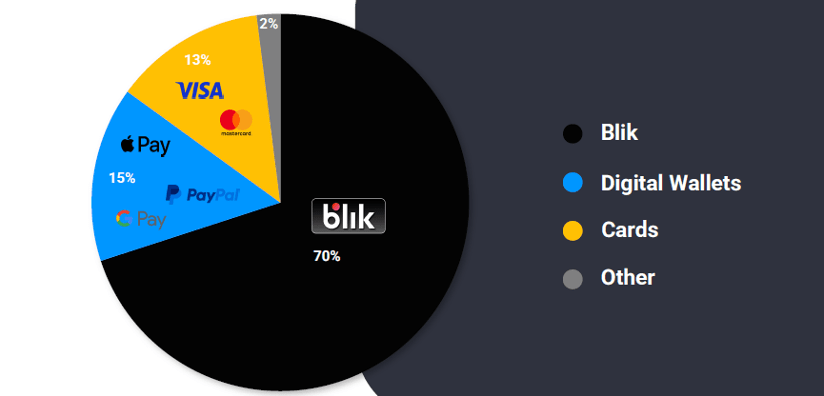

Similarly, Poland has seen a rise in using Blik, which accounted for 70% of e-commerce transactions in 2023, far exceeding card payments at 15%. Blik’s success is attributed to its ease of use, security features, and strong integration with local banking apps.

Payment Mix in Poland (2023)

| Payment Method | Percentage |

| Blik | 70% |

| Cards | 13% |

| Digital Wallets | 15% |

| Other | 2% |

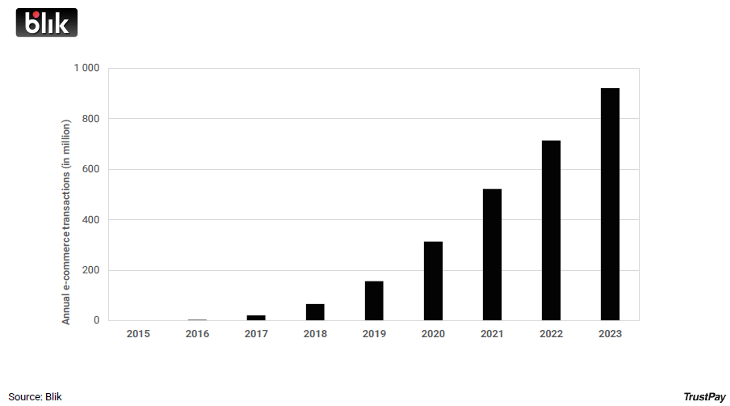

The chart displays the annual e-commerce transactions (in millions) for Blik from 2015 to 2023. It reveals a significant upward trend, starting with negligible transactions in 2015 and 2016. From 2017 onwards, there is a noticeable increase, with transactions rising steadily each year.

A sharp growth is evident from 2019, reaching around 200 million transactions, followed by a substantial jump in 2020 and continued acceleration through 2021 and 2022. By 2023, the transactions have soared to nearly 1 billion, indicating robust growth and increasing adoption of Blik for e-commerce transactions over the observed period.

Belgium also reflects this trend, with local payment methods like Payconiq by Bancontact capturing 65% of the market. This method offers seamless, QR code-based payments embedded into banking apps, reducing the need for manual data entry and enhancing security.

Payment Mix in Belgium (2023)

| Payment Method | Percentage |

| Payconiq, Bancontact | 65% |

| BNPL | 14% |

| Cards | 14% |

| Other | 7% |

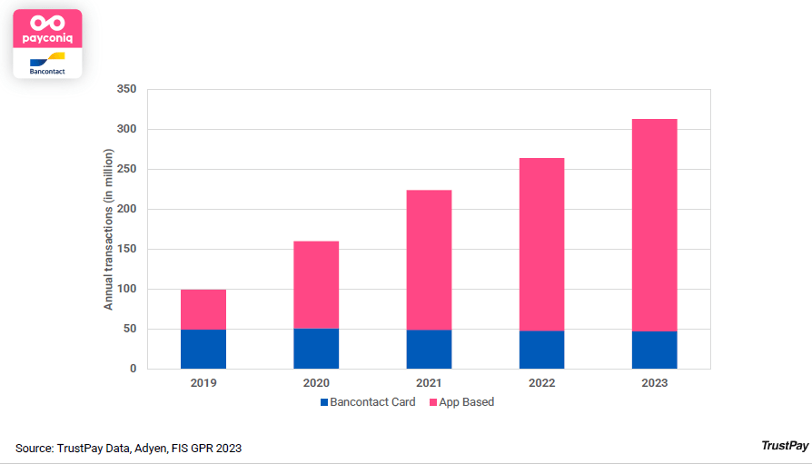

The chart illustrates the annual transactions (in millions) for Bancontact Card and App-based methods from 2019 to 2023, showcasing the evolution of local payment methods in the EU.

In 2018, Bancontact merged with Payconiq to create the mobile-first payment option, Payconiq by Bancontact. The data highlights a significant rise in app-based transactions, which have driven the overall growth. Interestingly, while the Bancontact Card solution has slightly decreased, it still lingers around the 50 million mark annually. This persistence indicates that older payment options tend to stick around for quite some time, even as new versions become available, reflecting a gradual shift in consumer adoption.

Key Drivers of Change

- Consumer Preferences: Consumers increasingly demand faster, more secure payment methods seamlessly integrated into their daily lives. This has led to the adoption of app-based and QR code payments.

- Regulatory Environment: Regulations like PSD2 (Payment Services Directive 2) in the European Union have encouraged the development of new payment methods by mandating open banking, facilitating direct bank-to-bank transactions.

- Technological Advancements: Fintech innovations have created more efficient payment systems that offer better user experiences and lower transaction costs compared to traditional card networks.

- Security Concerns: With rising concerns over data breaches and fraud, consumers and businesses prefer payment methods offering enhanced security features, such as tokenization and two-factor authentication.

Future Outlook

The future of e-commerce payments in Europe is poised for further fragmentation as more local payment methods emerge and existing ones continue to hold significant market share. Despite the growth of these methods, there are still challenges to be addressed:

- Payment Guarantees: Local payment methods often lack the payment guarantees that card networks provide, which can be a barrier to widespread adoption.

- Pan-European Reach: The lack of standardized API standards and user experiences across Europe hinders the development of a truly pan-European payment solution.

- Recurring Payments: Many local methods do not yet support recurring payments or one-click checkouts, limiting their use for subscription-based services.

However, the decline of traditional card payments is likely to continue as digital wallets and account-to-account (A2A) payment schemes gain traction. Their superior user experience and cost-effectiveness will drive the transition to these new methods.

In conclusion, the landscape of online payments in Europe is rapidly evolving, characterized by the rise of local payment methods and the gradual decline of traditional card payments. Businesses must stay agile and adapt to these changes to meet consumer demands and leverage the benefits of new payment technologies. Understanding these trends and their implications will be crucial for navigating the future of e-commerce payments in Europe.

Sources:

- TrustPay Data

- FIS GPR 2023

- Dutch Payment Association

- Blik

- Adyen