Network Tokenization: The next step in payment security and efficiency

Secure and seamless payment processing is more critical than ever in an increasingly digital world. Network tokenization has emerged as a vital technology designed to enhance security and convenience for merchants and consumers.

Secure and seamless payment processing is more critical than ever in an increasingly digital world. Network tokenization has emerged as a vital technology designed to enhance security and convenience for merchants and consumers. While acquirers have been utilizing acquirer-specific tokens for some time, Mastercard and Visa’s network tokenization sets a new standard for the industry.

- Balancing security & consumer experience is critical as remote payments are expected to exceed $5.6 Trillion by 2025. (1)

- 62% of merchants say their approach to fraud makes providing a smooth customer experience challenging. (2)

- 42% of merchants say their false decline rates are increasing. (2)

Let’s explore what this means for merchants and why embracing these innovations is a game-changer.

What is card tokenization?

Card tokenization substitutes the primary account number (PAN) with a unique token (a digital identifier), enabling seamless processing across all entities within the payments ecosystem. These tokens are linked to the original account, ensuring issuers can access complete transaction information.

Traditionally, tokenization has been implemented at the Payment Service Provider (PSP) level, where merchants rely on PSPs to generate and manage tokens. While effective in reducing PAN exposure in the e-commerce environment, the issuers never had the assurance of managing the tokens through card schemes.

The rise of network tokenization

Network tokenization takes this technology a step further by integrating it directly into Visa and Mastercard’s networks. Visa refers to its implementation as Visa Token Service, while Mastercard calls it Secure Card on File. This innovation enhances security and provides merchants with new tools to improve their payment processes and customer satisfaction.

Consumers choose to store their card on file with merchants for increased speed and convenience

- 80% of consumers have stored their payment information online, whether on merchants’ sites or applications. (3)

- 58% of consumers choose to store multiple payment cards on a merchant website 58%. (4)

- 56% of consumers cite convenience as the reason they choose to store their credit card information. (3)

Key benefits of Network Tokenization

Network tokenization optimizes the payment ecosystem by enhancing the security and performance of card credentials across digital commerce. Here are the consolidated benefits.

Enhanced security and fraud reduction

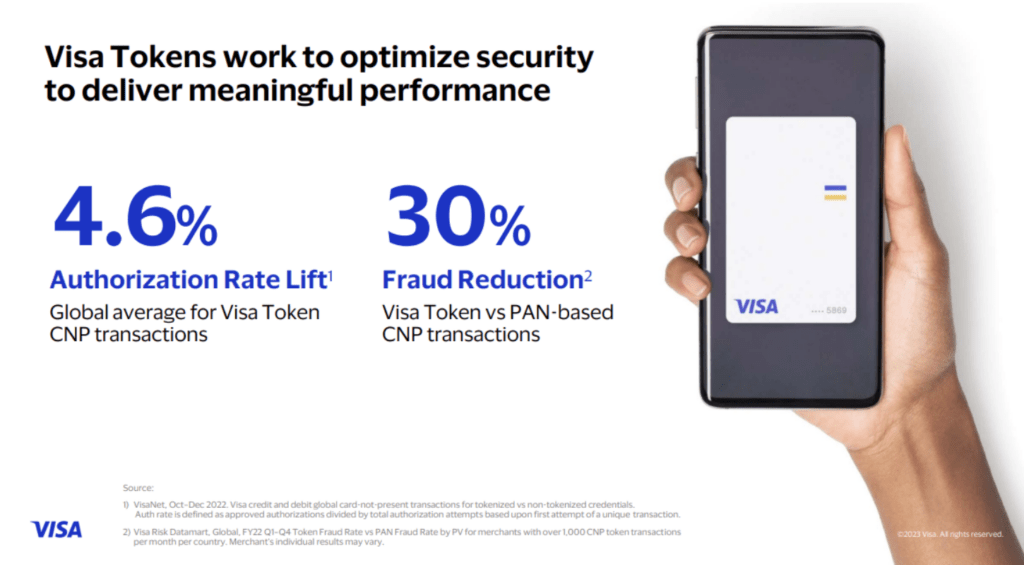

Tokens replace sensitive cardholder data, minimizing data breach risks, while domain controls, cryptograms, and issuer provisioning create a secure ecosystem for every transaction. Enriched data accompanying network tokens increases issuer confidence, reducing fraud and false declines.

Merchant-specific tokens further enhance protection by ensuring that stolen credentials cannot be reused in the e-commerce space in case of an account data compromise. Even if a token were compromised, fraudsters could not misuse it. By assigning a distinct token for each merchant and customer account, the risk of card misuse is significantly reduced, ensuring greater security for customers and merchants.

Higher authorization rates

Token and cryptogram combinations improve transparency and trust for issuers, leading to better authorization rates for merchants, as issuers receive more assurance that there is no ongoing fraudulent activity.

Seamless customer experience

Continuous card-on-file payments ensure recurring transactions are uninterrupted, even when cards are replaced or expire.

Improved user experience

Issuer card art and metadata allow merchants to display card visuals and configurations during checkout, personalizing the experience.

Tokens work seamlessly across various platforms and devices, ensuring smooth payment flows.

Why Network Tokenization matters for merchants

One standout feature of network tokenization is the Account Updater service, which ensures uninterrupted recurring payments and card-on-file transactions by automatically keeping stored card details up to date. When a card is replaced due to expiration, loss, or other changes, the service securely retrieves updated information from card networks (Visa, Mastercard). It seamlessly replaces outdated details through the merchant’s payment service provider or acquirer.

Exploring Network Tokenization with TrustPay

At TrustPay, we recognize the transformative potential of network tokenization. By partnering with Visa and Mastercard, we’ve integrated these advanced tokenization systems into our payment platform, offering merchants:

- Streamlined operations and enhanced checkout experiences.

- Unparalleled security with domain controls, cryptograms, and issuer provisioning.

- Tools like the Card Art API enable merchants to display card visuals for a more personalized interface.

Network tokenization represents the future of secure and efficient payment processing. By adopting these services, merchants can protect their customers and enhance their business operations.

At TrustPay, we’re proud to provide our clients with cutting-edge solutions that drive security, convenience, and customer satisfaction. Embrace the future of payments with TrustPay and experience the difference network tokenization can make.

1. Juniper Research, Online Payment Fraud, Deep Dive Strategy & Competition 2021-2025

2. 451 Research, S&P Global, Market Intelligence: CUSTOMER EXPERIENCE & COMMERCE | MERCHANT STUDY 2020

3. PYMNTS, “The Value of Vaults to Merchants,” 2023

4. Mastercard Global Foresights, Insights & Analytics Research, November 2023